Completing Policy Loan Request is not hard. Our experts created our editor to really make it intuitive and enable you to complete any form online. Below are a few steps you will want to stick to:

Step 1: The first thing will be to select the orange "Get Form Now" button.

Step 2: You can now modify your Policy Loan Request. You may use our multifunctional toolbar to include, remove, and modify the content of the file.

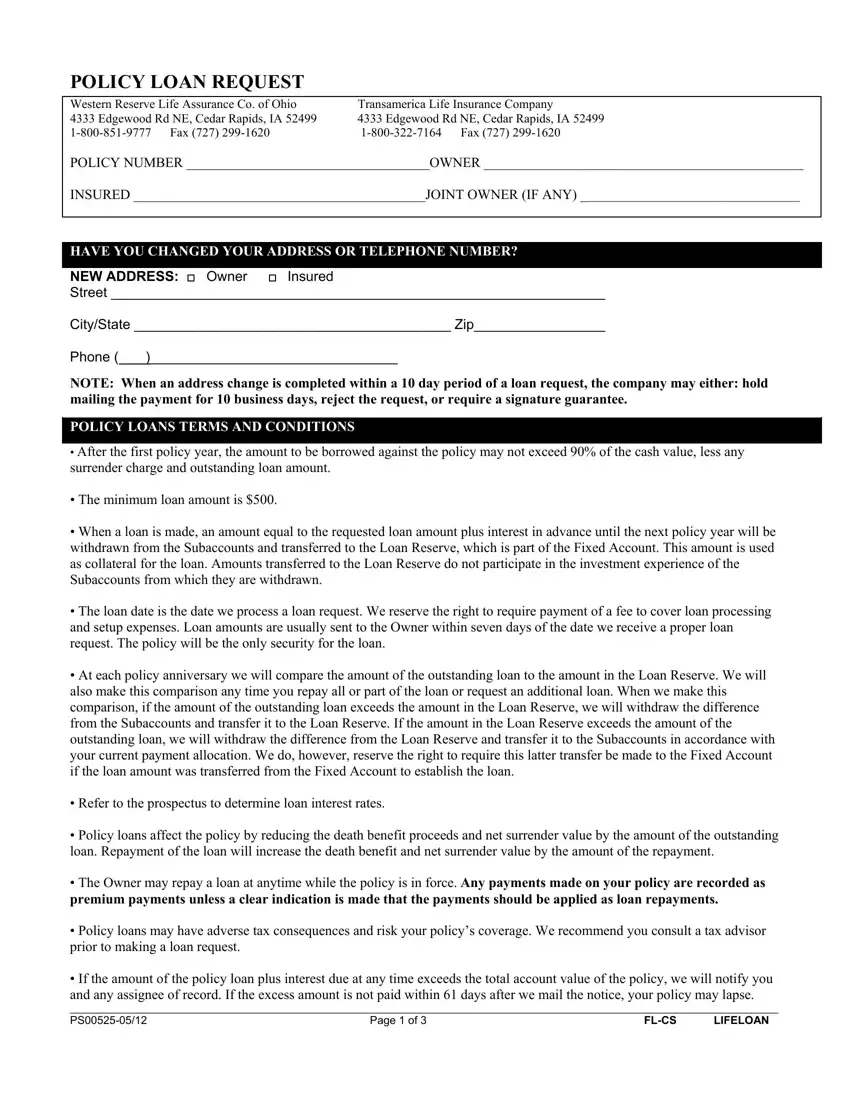

Create the Policy Loan Request PDF and enter the content for every single section:

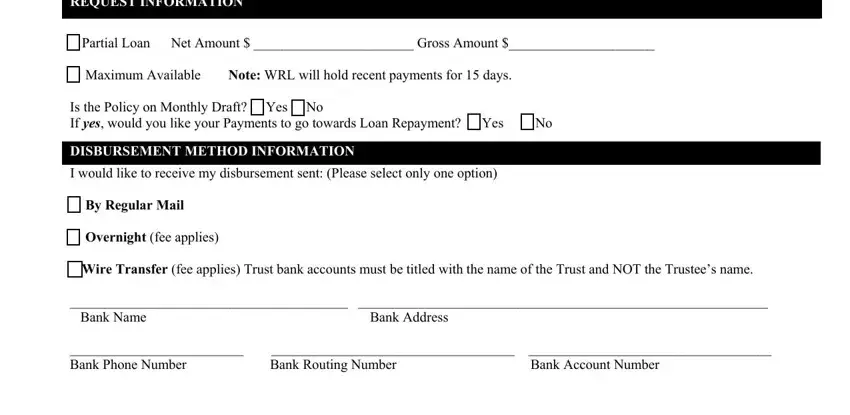

Type in the requested data in the REQUEST INFORMATION, Partial Loan Net Amount Gross, Maximum Available Note WRL will, Is the Policy on Monthly Draft, DISBURSEMENT METHOD INFORMATION, I would like to receive my, By Regular Mail, Overnight fee applies, Wire Transfer fee applies Trust, Bank Name, Bank Address, Bank Phone Number, Bank Account Number, and Bank Routing Number segment.

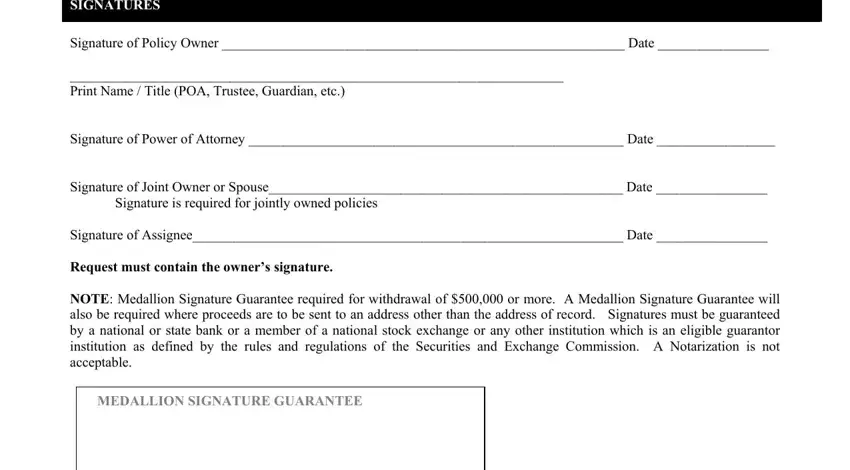

The software will demand for more info with the intention to quickly fill out the segment SIGNATURES, Signature of Policy Owner Date, Print Name Title POA Trustee, Signature of Power of Attorney, Signature of Joint Owner or Spouse, Signature of Assignee Date, Request must contain the owners, NOTE Medallion Signature Guarantee, and MEDALLION SIGNATURE GUARANTEE.

Step 3: As soon as you've clicked the Done button, your document is going to be available for upload to any type of gadget or email you indicate.

Step 4: In order to avoid any sort of difficulties in the foreseeable future, try to prepare as much as several copies of the document.